When you read "My path to the market group of friends will know, the group owner is 2013 contact to the foreign exchange margin this thing, so far there have been 9 years, the 9 years have paid too much tuition (title slightly exaggerated 😂), the group of friends "dresser" look forward to an article about if you exercise their own trading level, no longer trapped in a variety of trading emotions, the group owner read his said The owner of the group read his own "failed" trading history and felt a lot of emotions, so he decided to send this long-prepared trading tips today, as a stage reference, but also hope that those who come later can take some detours, or from find a new direction. strong>find a new direction, I will arrange the subsections of this article in a certain order, and I hope you will eventually understand why it is in this order after reading, without further ado, let's cut to the chase.

# Never borrow money to "do forex"!

I rarely use exclamation points in my posts, and if I do, it must be a very important thing, never borrow money to "do foreign exchange"! It's not like regular credit, borrowing money to do forex is overdrawing yourself against a 99.99999999999% failure rate! Don't lend money to anyone to do Forex, and don't borrow money from anyone to do Forex, whether it's an online loan or a credit card or a person, don't do it!

Here's why, suppose you have a basket, there are 100 eggs inside the basket, you use the 100 eggs to do business, then regardless of the loss or gain, your risk is controllable, is the 100 eggs, loss or gain, you still have chickens can lay eggs, there is the ability to rise again, so you go into business when you can let go of the hand operation. But if you think those 100 eggs are less and borrow another 1000 eggs from a 3rd party to go into business, then you're never going to make this business work! Not only because the risk you face is far greater than those 1,100 eggs, but you'll run for the hills from the psychological stress! Countless people are stupid in that they can never understand the difference between gambling and investing, and will always expect to make quick money to make big money, and the bad gambler will always be at the bottom of the social ladder, and will not change in a thousand years!

The most important thing about any investment is that the risk is controlled, ambition and strength does not match will only let you lose to the pants are left, the capital market is full of passion, but also the world of the weak and the strong, from borrowing the first money to do foreign exchange, you are already doomed to subsequent failure of the end, because the more losses you will be more and more borrowed, and eventually the hole is getting bigger and bigger, get separated from his wife and family, fall a lonely, at that time what There's no use for remorse! If you're reading this paragraph when you've already borrowed money to do Forex, go out now and fill the hole, stop giving money to the capitalists, please, spare yourself.

Never take a risk you can't take.

# Cherish your soldiers

If you only have 100 dollars in your account, then that 100 dollars is your 100 soldiers, and you have to rely on those 100 soldiers to survive in this chaotic world, and the first thing is to have a benevolent heart.

Soldiers are meant to go to war, and as a general you can't guarantee that everyone will eventually come home safely, but at least you can be a little more careful before making decisions and cherish these soldiers of yours a little more, because without them you will only die faster in a chaotic world.

Some may think the group is rather funny, money is money, why make it seem like you are fighting a war and have to line up your soldiers? Nothing wrong with that! It's all about lining up the troops.

You can plan it like this, the 100 soldiers, divided into four battalions of wind, forest, mountain and fire, 25 people per battalion, the wind battalion as the vanguard to explore, forest battalion as the main front army, fire battalion for mobile warfare, mountain battalion for the middle army support, wind battalion forest battalion fire battalion according to the battlefield situation in turn into the battlefield (rather than a brain all into), when they fight in the battlefield, always believe that there is a mountain battalion behind the ready to The situation on the battlefield is changing rapidly, and the army that has the right time, the right place and the right people at the beginning may not be able to laugh at the end, as the master of an army, you should be psychologically prepared for the sacrifice of soldiers, but at the same time, you cannot let the soldiers make meaningless sacrifices, and it is difficult to take back the military order once it is issued. Therefore, when controlling the overall situation, every strategic decision must be made carefully, and there must be a plan for both good and bad situations, so that the soldiers who carry out your orders will fight and kill without distractions, because they believe that you can lead them to victory, and what you control is not their life or death, but their trust.

If you have an indifferent attitude towards your soldiers (money), then you will eventually be abandoned by them as well. Having a benevolent heart does not mean you have to be a Grim Reaper, but to recognize the resources you have, see your strengths, and coalesce with your soldiers to fight hard for the hope of surviving tomorrow before your desires swell.

# Every deal needs to be costed

In a previous post "A Budding Guide to Quantitative Trading 2022", I talked about the theoretical underpinnings of transaction costs, and they need to be replicated here to emphasize them again. Here are the transaction costs that we will inevitably encounter in trading and that are easily overlooked:

- The cost of the spread (the difference between the bid price Ask and the ask price Bid

- Slippage cost (the difference between the price of your order and the actual price of the transaction is called slippage, the vast majority of platforms will be slippage, and it is not in your favor slippage)

- Swap interest (different varieties of overnight interest are different and will change)

- Price cost (touch the top of the bottom is to get a lower price cost)

- Margin cost (the margin tied up in a position is also a cost)

- Time cost (the time spent holding a position is a mild horizontal line cost)

- Risk cost (the cost of risk increases when the market price moves against you, and decreases when it does not)

There is something in the business world called Cost accounting, accounting for whether the deal is a good deal, how much it costs, how much you can make, how much you will lose if you smash your hand, to do foreign exchange, we also need to have cost accounting for the current position, for each order to have cost accounting, because from the moment you open a single, this part of the transaction cost you have paid out, and will also change with the cost of risk, with the cost of time So you need to pay attention to these costs and make sophisticated calculations, because you need to at least beat these transaction costs in order for you to preserve your capital, which is very difficult in itself, but once you get past this stage of capital preservation, taking profits will not seem so difficult. Many people tend to focus on taking profits, with only money in mind but no risk in sight, and no costing, and they only end up tripping at the stage of paying transaction costs and crying on their backs on all fours. Look ahead as you move forward, and capital preservation is the hardest and most overlooked challenge for 99% of traders. Once you start building a trading strategy with the goal of capital preservation, then the conversation around trading costs can be of sufficient interest to you.

So the question arises, how can you preserve your capital as much as possible? Let's take a crack at each of the various trading costs as listed above.

[Spread Costs].

Whether you use a platform with floating or fixed spreads, you need to pay attention to the average spread of the trading species, for example, the average is 30 pip, the maximum time 120 pip, the minimum time 10 pip, then you can overcome the cost of a point, is to choose to open / close positions within the spread average, spreads significantly wider and extremely volatile, generally means that a great risk event is about to The spread is significantly wider and extremely volatile, which generally means that a great risk event is about to happen or is happening, or the liquidity pool is drying up and the platform is having trouble finding orders to put together a deal, but of course, there is a situation where you can close a position regardless of the cost of the spread, and that is when the risk control is hard stop loss/hard stop gain, never mind how high the spread is, run away first.

[Slippage Costs]

Some platforms seem to have very low spreads, but in fact a lot of slippage, slippage in the mt4/mt5 background can be set, this is a fact that must be accepted, just this slippage some more and some less, in general, you can do is try to choose those slippage less big platform, and try to enter / exit when the battle is not so bad, in order to reduce the slippage as much as possible.

[Swap Rates]

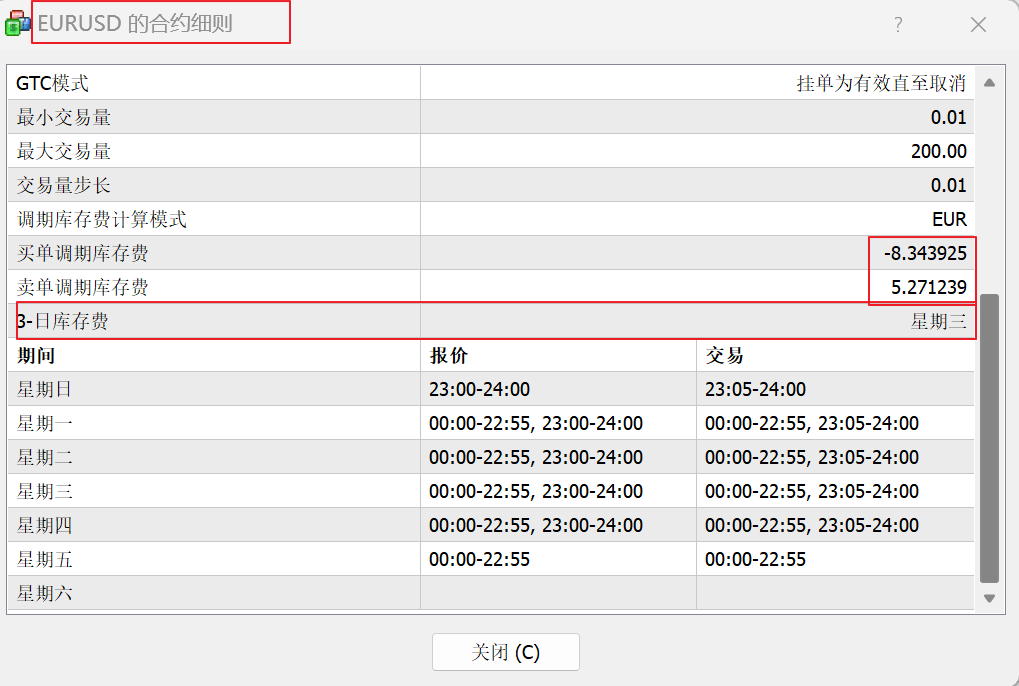

Overnight interest is a relatively mild cost, you only need to pay attention to the overnight interest is a negative variety, and according to the number of positions to calculate the daily increase in overnight interest, at least to do a number, for which currency is in a high interest state also need to know, which has a direct impact on the overnight interest, and you also need to know the day of the week is triple overnight interest (because Saturday and Sunday are not open, so a There will be one day in the week that is triple swap, which you can see in the variety specs).

Note that the times here are all platform times, not your local computer's time, which is here.

[Price Cost].

The same trading direction, my price cost is 1000 points lower than yours, it is destined that I can hold the single than you, reduce the price cost has to give very simple and effective way, is to use limit orders (Buylimit/Selllimit) to go to a better price level to deal, even though it may not deal, but if the deal, your price cost will be much lower.

Buying low and selling high, touching the top and plunging to the bottom, it's all a cliché, it boils down to being able to get in and out of the market at a more advantageous price, not only for entry but also for exit using limit orders.

Similarly, you can also use the virtual position shout single, and then floating loss with a single, you can operate exactly in accordance with their previous trading habits, only this time you are operating a demo account, when the overall floating loss of the demo account to more than a certain value, you then follow the single to the real account, you can also publish their own read-only password with various online "gods "account, and then choose the floating loss to follow the single.

[Margin Costs]

Margin determines the maximum position your account can currently open, and everyone's intuition is not the same, is locked margin is actually a cost, you may ask, just locked, this money and did not move, how to become a cost? I won't tell you the answer directly here, I'm sure you're smart enough to figure it out when you think about it.

The cost of margin is also one of the hard costs, although many people choose to lose a position, but in the case of lower leverage, the cost of margin accounting can also help to calculate a good single position, position step and the maximum position, if beyond their calculated value, either you have to choose to deposit, or you have to choose to reduce the position.

The value of prepayment ratio is a very good value for risk control, maybe you have gotten used to ignoring it for a long time, but now it's time to pick it up and blow it off.

[Cost of Time].

Time cost grows on a curve and is sort of better controlled. Contrary to most intuition, while time cost grows linearly, there is a burr in time cost if the order is fast in and fast out, meaning that if you only spend 3s of clock to open and close a position, your actual time cost is infinite. It can also be interpreted this way, the time cost is a flat curve that is steep and then gentle.

The time cost need not be overcome, just focus on it.

[Cost of Risk].

The cost of risk is subject to change with the market, when the market towards the development of your situation, the cost of risk in lower, when the market towards the adverse situation, the cost of risk in higher, here it is necessary to set a threshold for the cost of risk (yù) value, the cost of risk threshold is also the most basic value in the risk control tools.

The first step is to reduce the cost of your money, but without this first brick, there is no way to talk about the tall building that follows.

# Good use of wind control tools

Whether you are trading manually or EA trading, wind control tools are a must, you can set a loose wind control or set a strict wind control, in short, this thing you can not know, but know it can not be without. 😊

A standard wind control tool should contain the following features.

[overall floating profit/floating loss wind control]

The smart little Ming asked, floating loss of wind control I can understand, floating surplus why do you need wind control ah, here then need to first understand the profit and loss of the same source, that is, the risk and return is proportional, and the risk is always greater than the return, if there is a risk is much less than the return of the good thing, it is not your turn 🤣, floating surplus of wind control can be and floating loss of wind control is the same rules, only the value is different. A positive and a negative, this overall wind control threshold is hard wind control, reached this threshold must be reduced, here to note, is reduced, not liquidated, exit and entry in the ideal situation should be kept in step, that is, slow entry, and then slow exit.

[Single order hard stop loss/stop gain]

Smart Ming is going to ask, I already have the overall risk control, in order to have to set a hard stop loss/stop profit for a single order? Here you need to know what is a hard stop loss / take profit, hard stop loss / take profit is that you set after you hope never to hit the value, but if the black swan hit that value, the hard stop loss / take profit can protect